Payback Period Explained: Definitions, Formulas and Examples

Between mutually exclusive projects having similar return, the decision should be to invest in the project having the shortest payback period. Management uses the payback period calculation to decide what investments or projects to pursue. The payback period is the amount of time it takes to break even on an investment. The appropriate timeframe for an investment will vary depending on the type of project or investment and the expectations of those undertaking it. As you can see, the required rate of return is lower for the second project. If you have a cumulative cash flow balance, you made a good investment.

Payback Period: Definition, Formula, and Calculation

The Payback Period Calculator can calculate payback periods, discounted payback periods, average returns, and schedules of investments. There are a variety of ways to calculate a return on investment (ROI) — net present value, internal rate of return, breakeven — but the simplest is payback period. Unlike net present value , profitability index and internal rate of return method, payback method does not take into account the time value of money. A modified variant of this method is the discounted payback method which considers the time value of money.

Advantages

For instance, Jim’s buffer could break in 20 weeks and need repairs requiring even further investment costs. That’s why a shorter payback period is always preferred over a longer one. The more quickly the company can receive its initial cost in cash, the more acceptable and preferred the investment becomes. The Investment Decisions are a core area essential to strategic planning and financial management. You’ll examine capital budgeting techniques, including net present value, internal rate of return, and payback period, to assess potential investments.

Comparing Payback Period with Other Methods

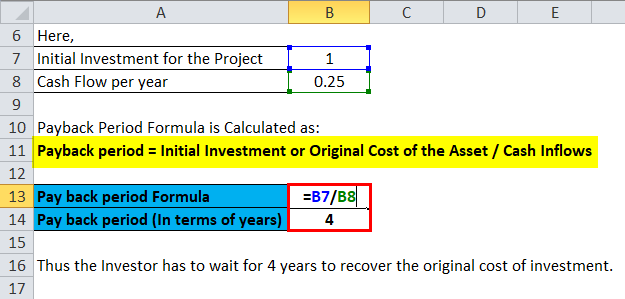

Let us understand the concept of how to calculate payback period with the help of some suitable examples. Cumulative net cash flow is the sum of inflows to date, minus the initial outflow. But since the payback period metric rarely comes out to be a precise, whole number, the more practical formula is as follows. So it would take two years before opening the new store locations has reached its break-even point and the initial investment has been recovered. Investors might also choose to add depreciation and taxes into the equation, to account for any lost value of an investment over time.

A young professional decides to contribute to a retirement account, such as a 401(k) or an IRA. This investment decision involves evaluating contribution limits, tax advantages, and investment options within the account. The individual considers their retirement goals and time horizon, deciding how much to invest regularly and which funds or assets to allocate within the retirement account to achieve growth over time.

- In Jim’s example, he has the option of purchasing equipment that will be paid back 40 weeks or 100 weeks.

- WACC can be used in place of discount rate for either of the calculations.

- We will also cover the formula to calculate it and some of the biggest advantages and disadvantages.

- Unlike the regular payback period, the discounted payback period metric considers this depreciation of your money.

Despite these limitations, discounted payback period methods can help with decision-making. It’s a simple way to compare different investment options and to see if an investment is worth pursuing. To calculate discounted payback period, you need to discount all of the cash flows back to their present value. The present value is the value of a future how big companies won new tax breaks from the trump administration payment or series of payments, discounted back to the present. According to payback method, the equipment should be purchased because the payback period of the equipment is 2.5 years which is shorter than the maximum desired payback period of 4 years. Machine X would cost $25,000 and would have a useful life of 10 years with zero salvage value.

The above equation only works when the expected annual cash flow from the investment is the same from year to year. If the company expects an “uneven cash flow”, then that has to be taken into account. At that point, each year will need to be considered separately and then added up.

If opening the new stores amounts to an initial investment of $400,000 and the expected cash flows from the stores would be $200,000 each year, then the period would be 2 years. Investors may use payback in conjunction with return on investment (ROI) to determine whether or not to invest or enter a trade. Corporations and business managers also use the payback period to evaluate the relative favorability of potential projects in conjunction with tools like IRR or NPV. A higher payback period means it will take longer for a company to cover its initial investment. All else being equal, it’s usually better for a company to have a lower payback period as this typically represents a less risky investment.

Recent Comments