Operating Expenses: A Comprehensive Guide to Business Cost Management

In this system, fixed costs are spread out over the number of units produced, making production more efficient as production increases by reducing the average per-unit cost of production. Economies of scale can allow large companies to sell the same goods as smaller companies for lower prices. Trimming operating costs too much can reduce a company’s productivity and, as a result, its profit as well.

However, most companies can deduct such expenses on their income tax forms in order to get a tax break. The policies are intended to cover not only its property and products but also to protect its workers. Unexpired premiums should be listed as prepaid insurance, which is listed in an asset account. The operating activities primarily cover the amend your tax return with sprintax commercial activities of the company. There are some costs that are infamously ballooned, like hotel bills, expensive dinners out, and first-class plane tickets.

Fixed vs. Variable Operating Expenses

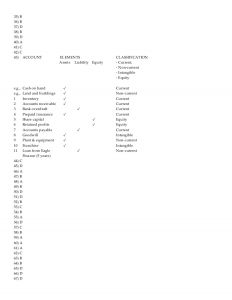

Operating expenses are the costs a company incurs to keep its business running, excluding costs directly tied to production. In this section, we will discuss various components of operating expenses. In addition, compensation and benefits for production personnel and direct labor may be classified under operating expenses for accounting purposes. These are costs that constantly and consistently occur, so a company cannot avoid them at all.

What Are Capital Expenses?

The IRS has guidelines related to how businesses must capitalize assets, and there are different classes for different types of assets. A non-operating expense is an expense incurred by a business that is unrelated to the business’s core operations. The most common types of non-operating expenses are interest charges or other costs of borrowing and losses on the disposal of assets. Accountants sometimes remove non-operating expenses to examine the performance of the business, ignoring the effects of financing and other irrelevant issues. Other operating expenses represent various negligible costs in the income statement.

What Are Operating Expenses?

Many businesses have accountants who control certain expenses to ensure that there is no abuse of privilege when it comes to corporate expenses. Because they are a financial expense that does not directly contribute to selling services or products, they aren’t considered assets. Investing in what are noncash expenses meaning and types energy-efficient equipment or upgrading existing systems can also help cut down utility costs significantly. This includes using LED lighting, installing programmable thermostats, and switching to renewable energy sources like solar power. Legal fees incurred by businesses form part of their operational budget since companies require legal assistance on matters such as contract negotiations or disputes with customers/clients/vendors/suppliers. However, it’s worth noting that not all types of insurance will necessarily be classified as an operating expense.

For example, if your business takes out life insurance policies on key employees or partners for succession planning purposes, this would likely be categorized as a non-operating expense. The disadvantage of looking at a company’s opex is that it is an absolute number, not a ratio. Therefore it is unreasonable to be used as a metric to compare between firms even if they are in the same industry. However, they can be highly instrumental in the horizontal analysis since it can reflect the company’s current performance in the past. Cost of Goods Sold refers to costs directly related to the production of your goods or service, including raw materials and labor costs.

- Operating expenses are one of the most substantial items on the income statement.

- Obviously, property insurance covers the building and land that a company owns, as well as whatever is inside.

- Optimise supplier relationships, streamline contract management and track savings efficiently with our all-in-one procurement platform.

- She has more than five years of experience working with non-profit organizations in a finance capacity.

Apart from these, non-operating expenses include single entry system definition financial costs, inventory write-downs, provisions, etc. The income statement is a financial statement that reports a company’s performance for a period. Usually, it presents the profits or losses a company makes during a period. The income statement also reports on activity through income and expenses. These items are crucial in helping companies calculate their earnings for a period.

SG&A includes nearly everything that isn’t in the cost of goods sold (COGS). Operating costs include COGS plus all operating expenses, including SG&A. The economies of scale principle can be limited in that fixed costs generally need to increase with certain benchmarks in production growth. Fixed costs can help in achieving economies of scale, as when many of a company’s costs are fixed, the company can make more profit per unit as it produces more units.

Recent Comments