4 Ways to Calculate NPV

The difference between the present value of the cash inflows and the present value of cash outflows is known as net present value (NPV). As you can see, the net present value formula is calculated by subtracting the PV of the initial investment from the PV of the money that the investment will make in the future. The cost of capital is the rate of return that an organization must earn on its investments to satisfy investors and lenders. It serves as a benchmark for evaluating new projects and investments, guiding financial decisions to ensure that returns meet or exceed investor expectations.

Determine the Discount Rate

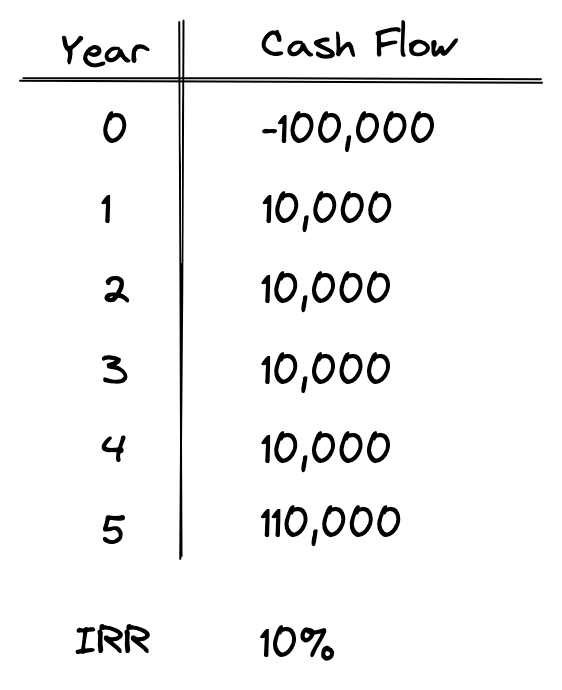

It also assumes that cash flows will be received at regular intervals, which may not always be the case. Additionally, NPV does not take into account non-financial factors such as risk, which can also impact investment decisions. Finally, a terminal value is used to value the company beyond the forecast period, and all cash flows are discounted back to the present at the firm’s weighted average cost of capital. In addition to factoring all revenues and costs, it also takes into account the timing of each cash flow, which can result in a large impact on the present value of an investment. For example, it’s better to see cash inflows sooner and cash outflows later, compared to the opposite. On the other hand, IRR is a measure of returns that focuses on the rate at which invested capital grows over time and does not consider the present value of future cash flows.

Net Present Value (NPV): What It Means and Steps to Calculate It

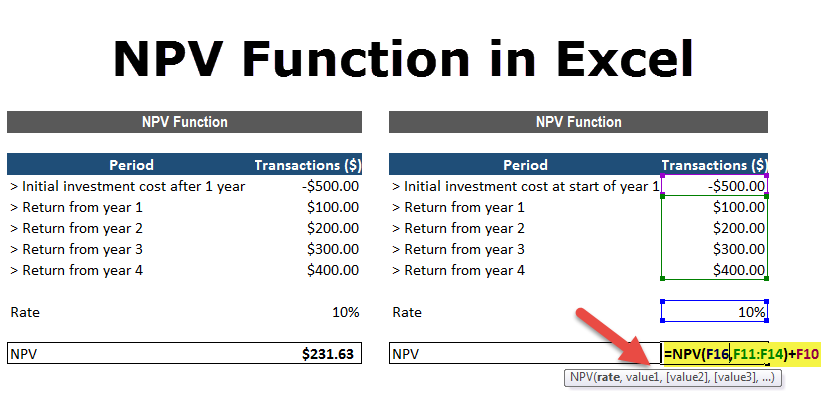

For instance, if you run a business and expect cash flows to be received evenly over a year, the NPV calculation may need to accurately reflect the project’s actual value. You should also set a higher margin of safety when evaluating projects with a longer timeline or uncertain cash flow projections. For instance, you may only accept projects with an NPV of at least 10% instead of one that generates a 5% return. Below is a short video explanation of how the formula works, including a detailed example with an illustration of how future cash flows become discounted back to the present. In most cases, a financial analyst needs to calculate the net present value of a series of cash flows, not just one individual cash flow. The formula works in the same way, however, each cash flow has to be discounted individually, and then all of them are added together.

Evaluating Various Types of Investments

In case of mutually exclusive projects (i.e. competing projects), accept the project with higher NPV. Remember, when calculating NPV, it’s essential to factor in inflation, as this will individual income tax forms affect the calculation. Sign up for free and start making decisions for your business with confidence. Below is an example of a DCF model from one of CFI’s financial modeling courses.

More Helpful Resources

Finally, subtract the initial investment from the sum of the present values of all cash flows to determine the NPV of the investment or project. Both NPV and ROI (return on investment) are important, but they serve different purposes. NPV provides a dollar amount that indicates the projected profitability of an investment, considering the time value of money.

What is your risk tolerance?

The present value of net cash flows is determined at a discount rate which is reflective of the project risk. The payback period is calculated by dividing the initial cost of an investment by the annual cash flow generated from that investment. The result is expressed in years; the shorter the payback period, the better. It means if the equipment is not purchased and the money is invested elsewhere, the company would be able to earn 20% return on its investment. The minimum required rate of return (20% in our example) is used to discount the cash inflow to its present value and is, therefore, also known as discount rate. A financial calculator is able to calculate a series of present values in the background for you, automating much of the process.

The discount factor is the cost of borrowing money or the rate of return payable to investors. It’s specific to the business in question and usually set by the Chief Financial Officer. The net present value (NPV) represents the discounted values of future cash inflows and outflows related to a specific investment or project. The internal rate of return (IRR) is calculated by solving the NPV formula for the discount rate required to make NPV equal zero.

- In this example, the NPV is $8,805, which means the project is expected to generate a positive return of $6,805.

- Learn more about NPV and risk assessment today to get the most out of your investments.

- The payback period calculates how long it will take for the initial investment to be recovered from the project’s cash inflows.

To illustrate the concept, the first five payments are displayed in the table below. In the context of evaluating corporate securities, the net present value calculation is often called discounted cash flow (DCF) analysis. It’s the method used by Warren Buffett to compare the NPV of a company’s future DCFs with its current price. NPV measures the difference between the present value of cash inflows and the present value of cash outflows over a project’s lifetime.

Theoretically, any project with a positive NPV should be accepted as it is expected to generate returns above the initial investment. The management of Fine Electronics Company is considering to purchase an equipment to be attached with the main manufacturing machine. The equipment will cost $6,000 and will increase annual cash inflow by $2,200. Management is looking to expand into larger jobs but doesn’t have the equipment to do so.

Here is the mathematical formula for calculating the present value of an individual cash flow. The Net Present Value tells you if your investment is likely to make a profit over a set period of time. But you know that this future money is worth less than today’s money, so you want to get a more accurate picture by using the Net Present Value Calculation. Net Present Value (NVP) is one of the ways to analyse an investment to see if it’s worth the risk. Get instant access to video lessons taught by experienced investment bankers.

Recent Comments